Understanding a title commitment can be fairly easy or, in some cases, tough enough to require professional legal advice. It varies from property to property depending on the age of the home and history of ownership.

Before diving into the title commitment itself, let’s first cover a few of the basics.

What Is Title?

Title, or being on title, is the legal right of ownership of property. A property’s title lists all legal owners as well as any entity that has a claim against it.

When a home is sold the title passes from the seller to the buyer. The listed history of these transfers of ownership is what’s called the chain of title.

During the purchase process, the chain of title is reviewed to confirm that the seller has the legal right to sell and that the buyer can take possession of the property without encumbrances that could jeopardize ownership.

What Are Encumbrances?

Encumbrances, or encumbrances on title, are claims against the property by an entity that is not the owner.

Common types of encumbrances are:

- Liens

- Covenants, conditions, and restrictions

- Easements

1. Liens

A lien is a claim placed against a property to satisfy the debt of the existing or a previous owner.

Liens are more common than not. A mortgage, which most homeowners have, is a type of lien. If a buyer takes out a mortgage to purchase a home, the lender will have a claim against the property being purchased. If the buyer defaults on the loan, the lender can then force the sale of the property to pay off the buyer’s debt.

While the impact of liens can be significant, most contracts for sale require the seller to settle these claims and have the liens removed before closing.

2. Covenants, Conditions, and Restrictions

Covenants, conditions, and restrictions (CC&Rs) impose restrictions on what an owner can and cannot do with their property.

Common examples of CC&Rs are:

- Property maintenance – may require that the home has its lawn regularly mowed or exterior painted.

- Home decorations – may limit when and how the home is decorated.

- Pets – may prohibit specific pets, such as livestock or certain dog breeds, or limit the number of pets allowed to live in the home.

- Parking – may prohibit vehicle parking in specific areas and limit overnight guest parking.

- Garbage/unsightly Items – may require trash containers, utility meters, and clotheslines be enclosed or appropriately hidden from view.

If a home is governed by CC&Rs, buyers should review them carefully prior to purchasing to ensure that they will not impact their ability to enjoy the home.

3. Easements

An easement is a legal right to use someone else’s property for a specific purpose. Common types of easements are for utilities and ingress and egress.

- Utility easement – gives the utility company the right to maintain utility lines over (or under) the property. In doing so, the utility company has the right to access the property as needed to work on the lines.

- Ingress and egress easement – gives neighbors the right to travel over the property to access their own. This is generally the result of a shared driveway or private road.

Because easements have the potential to restrict usability and affect property value, buyers should review them carefully prior to purchasing.

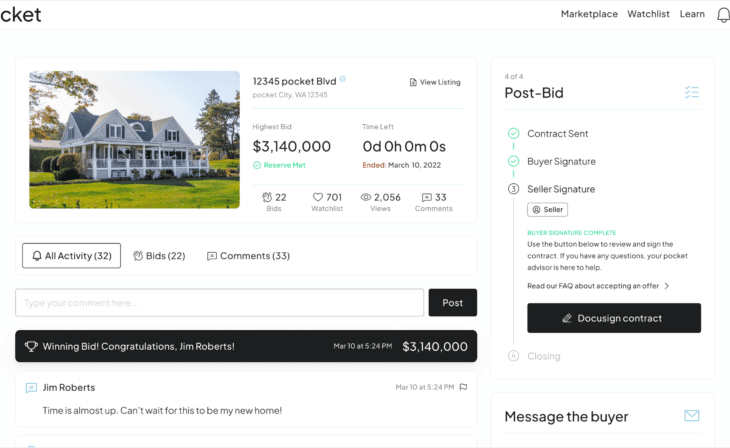

Is a Title Commitment Different Than a Title Report?

Yes. A title commitment and a title report are very different.

- Title commitment – is a promise by a title insurance company to issue a title insurance policy after closing. It contains the same terms, conditions and exclusions that will be included in the actual title insurance policy. The title commitment also identifies any issues, requirements, or encumbrances that need to be addressed prior to closing so that the title insurance policy can be issued.

- Title report – often a section in the title commitment, shows ownership and encumbrances.

Reading a Title Commitment

Now that we’ve covered the basics, we’re ready to dive into the title commitment. The title commitment is broken up into two sections, Schedule A and Schedule B.

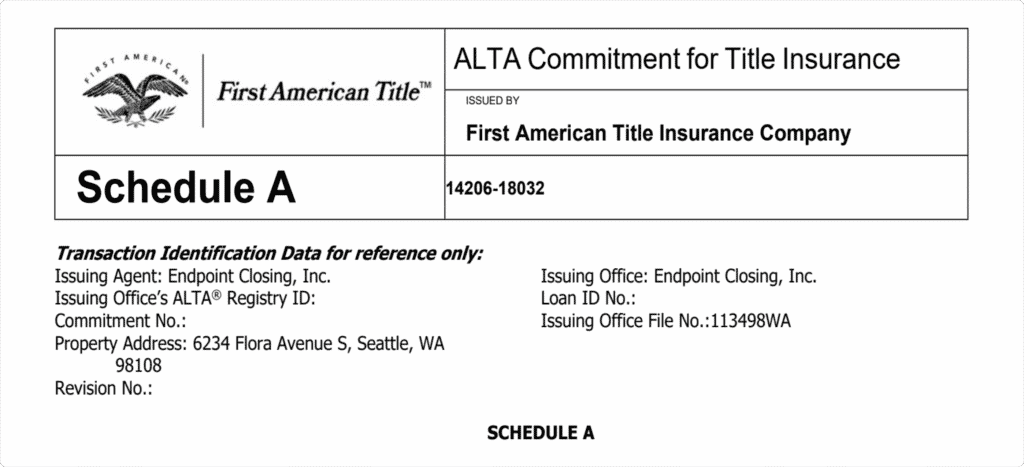

Schedule A

This section covers the basics of the transaction – names of the current owners, the legal description of the property, names of the proposed buyers, the sales price, and the name of the lender. While this section is fairly straightforward, errors in accuracy can and will occur. To avoid costly delays, make sure to double and triple-check all information listed.

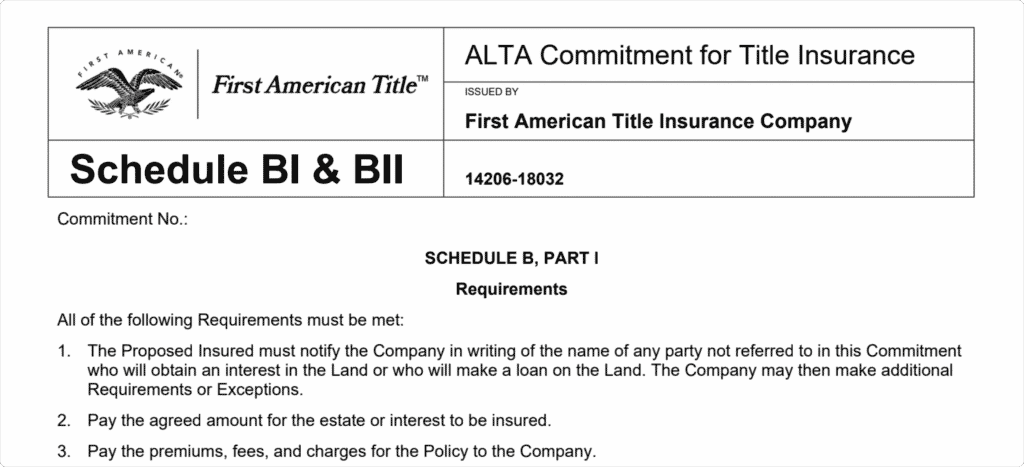

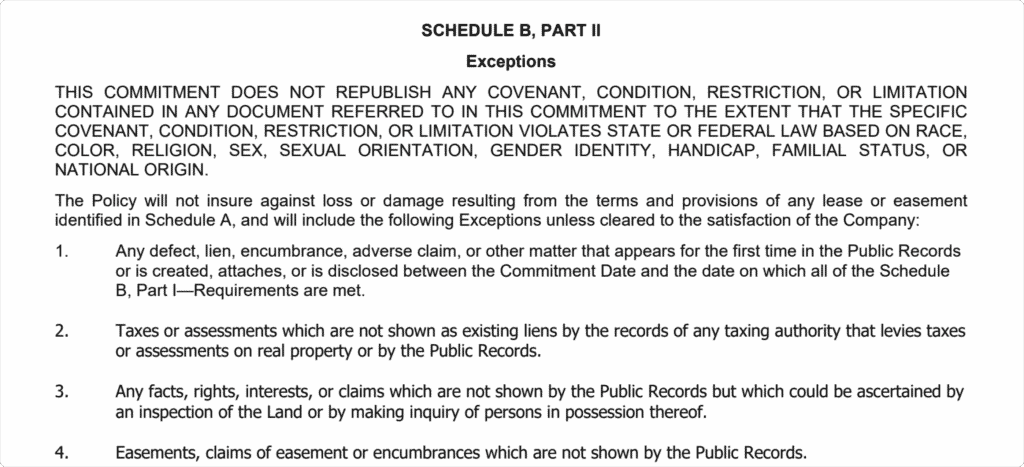

Schedule B

This section covers what actions need to be taken for the title insurance policy to be issued and what items will not be covered. It is broken down into requirements and exceptions.

Part 1 – Requirements

Requirements are all items that must be resolved prior to or at closing.

These include but are not limited to:

- Paying off taxes

- Paying off the seller’s existing mortgage

- Releasing liens on the title

- Recording the new deed and any new loan documents

- Correcting any errors in the title

Part 2 – Exceptions

Exceptions are all items that will not be covered by the title insurance policy and therefore do not require resolution. If there are encumbrances listed here that cannot be removed by evidence of being remedied, the buyer will be bound by them. Make sure to review this section and immediately notify the title company of any errors.

Examples include:

- Mineral and water rights

- Utility and access easements

- Covenants, conditions, and restrictions (CC&Rs)

- Existing plat restrictions

Hmmm.

The complexity of title varies from one home to the next and with it the ease of understanding the title commitment.

More often than not, another person or entity will have some legal right to or interest in the property being purchased. This interest could be as simple as a mortgage lien, immediately paid by the seller at closing, or as complicated as an easement that limits the buyer’s use of the property.

In either case, when purchasing property, it is important to understand the implications and limitations of its title. If the title is straightforward, great! If not, and there are items that are difficult to understand don’t take any chances. Have the title reviewed by an expert, a real estate attorney not a broker, to identify any encumbrances of concern.

For more information about title, check out title contingency explained.