What Is a Seller’s Disclosure Statement?

A seller’s disclosure statement, commonly known as a seller’s disclosure, is a legal document that outlines a home’s history and lists any issues that the seller is aware of. The seller’s disclosure is provided by the seller to the buyer before closing in order to help the buyer make an informed decision on whether or not to purchase a home. After the sale is complete, a seller’s disclosure can also help protect the seller from being sued by the buyer for any issues previously disclosed in the disclosure statement.

What’s Included in a Seller’s Disclosure?

The requirements for what has to be disclosed in a seller’s disclosure vary from state to state and some states don’t require disclosures at the state level at all. However federally required disclosures, such as the disclosing lead-based paint in homes built before 1978, must always be provided.

For the states that do require disclosures, what is or isn’t required in the seller’s disclosure depends in part, on what the state considers a “material fact”.

Material fact – something that could influence a buyer’s decision on whether to purchase a home.

Sounds pretty subjective and intentionally ambiguous right? Fortunately for you, these states all have seller discloser forms that clearly list what items need to be disclosed.

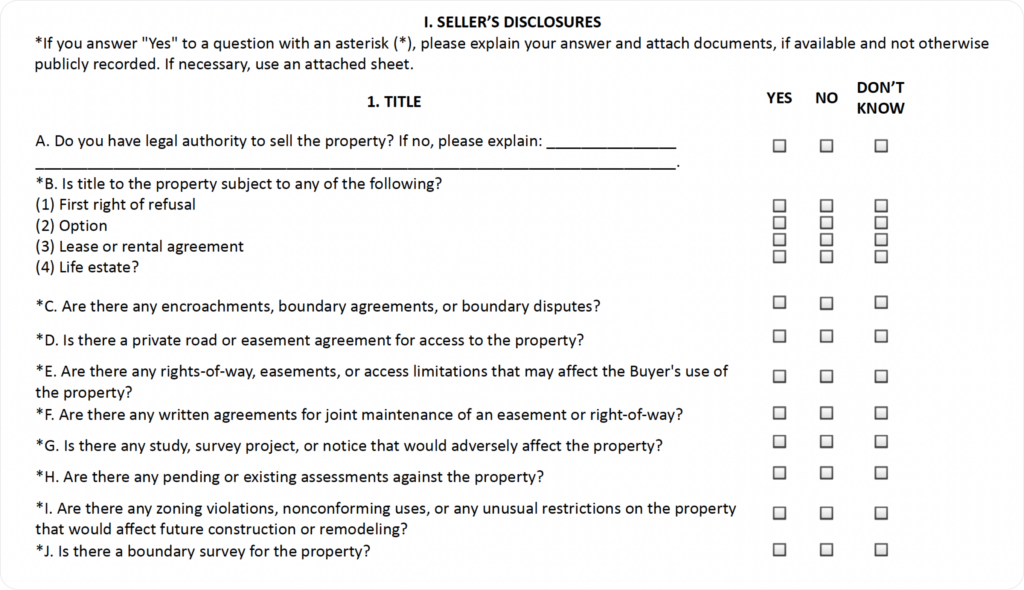

For example, in Washington state the seller disclosure statement requires:

- Title – you must disclose that you have the legal authority to sell the property (the property must be in your name and no one else can have a right of first refusal, an option to purchase, a lease or rental agreement covering, or a life estate in the property). This section also covers legal issues like easements and zoning violations.

- Water –you must disclose the source of your household water (whether you have a well or obtain water from the public water system), whether the property receives irrigation water, and whether or not the property has an outdoor sprinkler system.

- Sewer/on-site sewage system – you must disclose details about what type of sewage disposal system the property utilizes, and various fee and permitting issues.

- Structural – you must disclose information about the general structure of the building such as its age, whether the roof has leaked, whether there are any defects with the chimney or the foundation, and whether you’ve had pest infestations.

- Systems and fixtures – you must disclose all items that are being included with the property as part of the sale, such as the electrical system, the plumbing system, and the hot water tank. You must also disclose any defects with any of these included items, and state whether your property has smoke alarms.

- Homeowners’ association/common interests – you must disclose if your property is a condo or part of some other development that’s governed by a homeowners’ association (HOA), and if so, provide the contact information for the person who can give the buyer copies of the relevant documents. You must also state whether there are any common areas or joint maintenance agreements for shared features of the property like walls, fences, or landscaping.

- Environmental – you must disclose flooding, drainage problems, or material damage or contamination to the property due to events such as fire, earthquakes, or landslides.

- Manufactured and mobile homes – if the property includes a manufactured or mobile home, you’ll need to make a few additional disclosures regarding any alterations made to the unit.

- Full disclosure by sellers – this is the ‘catch-all’ provision, emphasizing the importance of these disclosures: If there is anything that could affect the property that you have not covered by the categories already addressed and that the buyer “should know about,” you must disclose it here.

Common Things That Probably Need to Be Disclosed

Repairs

Sellers may be required to disclose a list of all of the major repairs made to the home and surrounding property. Buyers not only want to know about past problems, they also want to know if the issues were fixed, how they were fixed and if there is continued work or maintenance required to keep them fixed.

Damage, Hazards and Faulty Systems

Anything that may cause major foundations issues, endanger the prospective buyer or jeopardize the integrity of the home most likely will need to be disclosed. This may include but is not limited to:

- Water damage

- Cracks in the foundation

- Termites/Termite damage

- Infestations

- Asbestos

- Radon

- Lead paint

- Damaged or malfunctioning systems, including plumbing and electrical

Nearby Annoyances

Some states may require the seller to disclose certain types of noises, odors and neighborhood occurrences that could potentially annoy a prospective homeowner or make living conditions unbearable. This could also include disclosing your home’s proximity to causes of these annoyances, including farms, airports, shooting ranges, landfills and military bases.

Liens on the Property

If there is a lien on the property, the seller must receive the lien holder’s permission to sell. If permission is given, the seller must disclose the lien to prospective buyers.

Property Line Disputes

Property line disputes must also be disclosed. If there is pending action against the home by one of their potential future neighbors, buyers need to know about the claim.

Actually Filling Out the Disclosure Statement

In states that require a seller’s disclosure, the process for filling out the form is actually pretty straightforward. It does vary from state to state, but generally you’re faced with answering questions in a “yes”, “no” or “don’t know” format and then providing subsequent explanations to any of the “yes” answers.

It’s important to note, that when filling out the disclosure the information you are required to provide only has to be to the best of your knowledge. Meaning, you do not need to go searching for issues you are currently unaware of. You simply have to disclose what you were told about the home when you purchased it and any issues you’ve had since you’ve owned it.

What Happens if I Fail to Disclose Something?

Unknowingly failing to disclose or providing inaccurate information in your seller’s disclosure, while unfortunate for the buyer, should not lead to any legal legal action. Again, the information you are providing is to the best of your knowledge and may rely on your ability to recall conversations that are years or even decades old.

However, if you knowingly fail to disclose or intentionally provide inaccurate information to the buyer then the consequences can be severe. If the buyer finds out before the sale, then they can cancel the contract without penalty and you may be required to pay some sort of fee. However, if the buyer doesn’t find out until after the sale, they then can take legal action against you which could result in significant financial consequences.

The Bottom Line

In states that require them, filling out a seller’s disclosure is incredibly easy, gives buyers the information they need to feel confident about completing the purchase of your home, and protects you from any future liability.